What you need to know about shipping to the European Union and IOSS numbers

As a company that ships to customers around the globe, we understand that international shipping can be a headache; taxes and policy changes in a county halfway around the world have an impact on how you interact with your customers. We want to make your shipping experience as smooth and enjoyable as possible, so we’re always ready to offer helpful resources when we notice policy changes that could affect you!

Changes in regards to European Taxes

The European Union, much like the United Kingdom, has recently made some changes to their VAT - value-added tax - policies. Along with some changes to maximum spending allowance without taxation, the most significant change the EU has implemented is the creation of the Import One-Stop Shop (IOSS). The IOSS is the “electronic portal businesses can use… to comply with their VAT e-commerce obligations on distance sales of imported goods”. Essentially what the IOSS does is allow sellers to collect, declare and pay the VAT on the imported goods on behalf of their customers at the time of purchase, before the product arrives in the EU. This saves your buyers from having to pay the VAT as soon as the package arrives in their country, making the release and delivery of that package to your customers much more seamless.

How do these changes affect you?

How does this affect you and your e-commerce business? Great question! The reality for most of our customers is that sales to the EU make up a small percentage of total sales and revenue. Because of this reality, Art Of Where won’t be collecting the EU VAT for EU sales on our website. This means that none of you will have to register with the Import One-Stop Shop! Instead, we will be allowing the European border services to collect the required VAT upon the package’s entry into its destination country. While the IOSS can be a great feature for businesses that have a high quantity of sales to the EU, it can also be more of a headache for those that do not.

Since VAT will be collected upon delivery rather than upon the initial transaction, your customers will be responsible for paying those taxes and any other associated fees before they can receive their package. It’s important that you make any of your EU customers aware of this so that there are no surprises for them when their much anticipated parcel arrives.

Etsy Sellers

Etsy store owners with an Art of Where integration

If you have an Etsy store connected to Art of Where, we have good news for you! Etsy is a marketplace and will collect the EU taxes when purchases are made on their platform. When we receive your integrated order, we use Etsy’s IOSS number and include it on the commercial invoice sent with the package. So there's nothing you need to do beyond making the sale, and between Etsy and us, we'll do the leg work for you.

Esty store owners without an Art of Where integration

We've notcied that some Etsy sellers prefer to place orders manually and not through the integration. In this case, we cannot know the amount of taxes paid on the order so we cannot declare any tax paid on the package. In this case, your customer will have paid taxes on Etsy and then will be charged the additional taxes when the package is delivered. We highly recommend that you connect your Etsy store to Art of Where via out integration to prevent this double-tax charge.

Do you have an IOSS number?

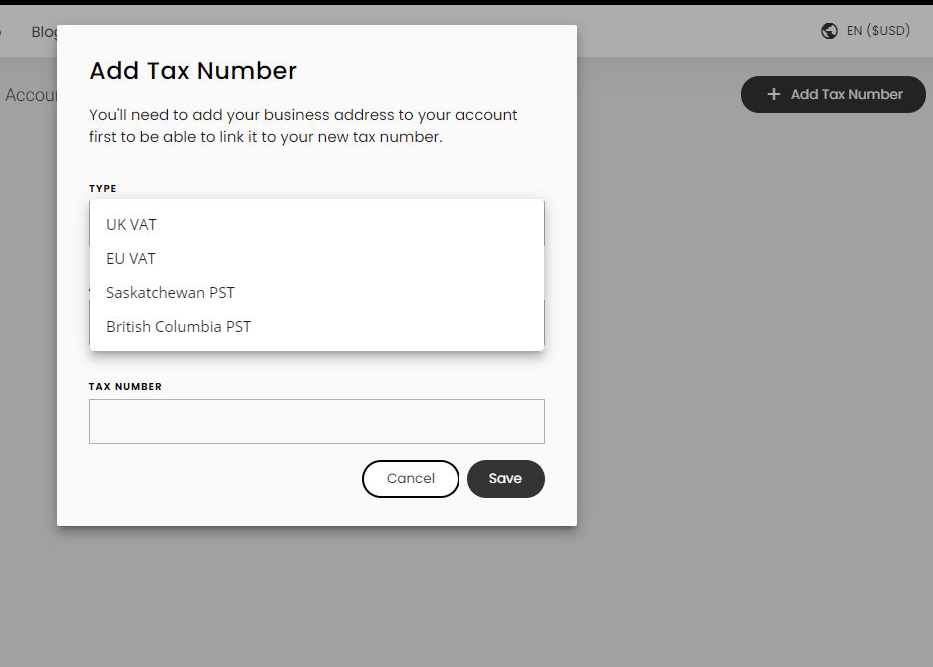

If you have your own IOSS number, you can enter it into your account under the new Tax Numbers tab. In this case, we'll know not to charge you taxes on orders shipping to the EU.

If you have your own IOSS number, make sure you are following closely the regulations surrounding collecting and submitting your IOSS returns regularly.

Have questions about tax numbers? You can read more about VAT in the UK and if you have more questions, get in touch with us! Taxes will only get more complicated as countries evolve their policies so it's best to stay up-to-date so your business runs smoothly.