All about VAT in the UK for your art-based drop ship business

For those of you who haven’t already heard, the UK has recently made some changes to one of its taxes called VAT - value-added tax. Basically this is a consumer tax that’s placed on a good whenever value is added to that good along the line of production. This isn’t a new tax and exists in many countries around the world already - in Canada it’s referred to as GST/PST/QST; in Australia it’s GST; in Japan it’s JCT - however the EU has recently amended the tax to include a wider scope of taxable products.

As of January 1st, new regulations came into place regarding the collection of VAT. Instead of it being collected at the border, some orders now need the VAT collected in advance of shipping. There has been a grace period, but the deadline to comply of July 1st is almost upon us! It’s important you take some time over the next few days/weeks to decide how to proceed with VAT for your business. Reading this article is a great first step!

When does VAT apply?

VAT applies to goods being brought into the UK to ensure that UK local businesses are not “disadvantaged by competition from VAT-free imports”. For anyone looking to export goods to buyers in the UK, you will need to register with the HM Revenue and Customs (HMRC) for a VAT number. This number will allow you to charge the value-added tax to your customers in the UK. For more specific info about what exactly VAT is and what it applies to, check out this informative article from the UK government.

VAT applies to all orders from £1-135 (roughly 150USD) in value. For orders over this value, the VAT will be charged directly to the customer at the border (how it has been done up until the current changes). Previously, low-value orders under £15 were exempt from VAT but this no longer applies.

Etsy Shop Owners

If you have an Etsy shop, we have good news for you! Since Etsy is a marketplace, Esty is responsible for collecting and remitting the VAT to HMRC. The invoice your customer receives from Etsy will detail their tax contribution and Etsy will handle the filing for you.

Points to consider for your business

First off, we’d like to stress that the information or advice we give in this article is not professional tax advice and that we recommend you consult a tax specialist for your specific situation. As your business grows and gets more complex, consulting professionals is mandatory to ensure you are operating in respect of regulations.

As an Art of Where customer you may be wondering what exactly you need to do in light of these adjustments. We’ll keep it as simple as possible! We’ve outlined the following steps for you so that you can navigate setting up VAT for your art-based business.

Scenario 1. You are located outside of the UK and would like to continue selling to customers in the UK.

If you are in this scenario (which is the vast majority of our customers), you have 2 options:

1. Get a VAT number. You will charge the VAT at your point of sale and remit it directly to the HMRC. Filings to the HMRC must be done by you quarterly. By entering your VAT number in your Art of Where account, we won’t charge you VAT on shipments to the UK. Your VAT number will appear on your shipments.

2. Don’t get a VAT number. In this case, Art of Where will charge you VAT on your orders that ship to the UK. Your orders will ship under our VAT number. You may need to consider the impact of this option on your product pricing.

Scenario 2. You are located in the UK and sell products to UK customers.

If you are a UK citizen with a business, it is important to be aware of your VAT taxable turnover. Your VAT taxable turnover is the total of everything sold that is not VAT exempt.

You must register for VAT if:

-

You expect your VAT taxable turnover to be more than £85,000 in the next 30-day period.

-

Your business had a VAT taxable turnover of more than £85,000 over the last 12 months.

Once you have your VAT number, enter it into your Art of Where account and we will not charge you VAT on your orders.

As a business in the UK, make sure to stay up-to-date with news and regulations. This link from the HMRC is a good place to start.

Scenario 3. You decide to not to sell products to customers in the UK.

As a business owner, you can decide not to ship products to the UK. Depending on the amount of UK customers you have, the difference may be minor.

However, it is good to start understanding tax laws now since many countries are changing how taxes for their citizens work. In order to keep your customer base as large as possible, understanding taxes and how to set them up for your business will be more and more vital as time goes on.

Setting up a VAT number in your Art of Where account.

Step 1) Register for a VAT number.

Registering for a VAT number with the HMRC can easily be done online for most businesses. This process can take 2-4 weeks so start this step asap!

Step 2) Apply VAT to your e-commerce store.

Most e-commerce platforms have already made the necessary taxation changes to allow for the VAT adjustments. A quick search in the help section of your chosen platform will tell you exactly how to update your tax settings so that UK customers can be charged VAT.

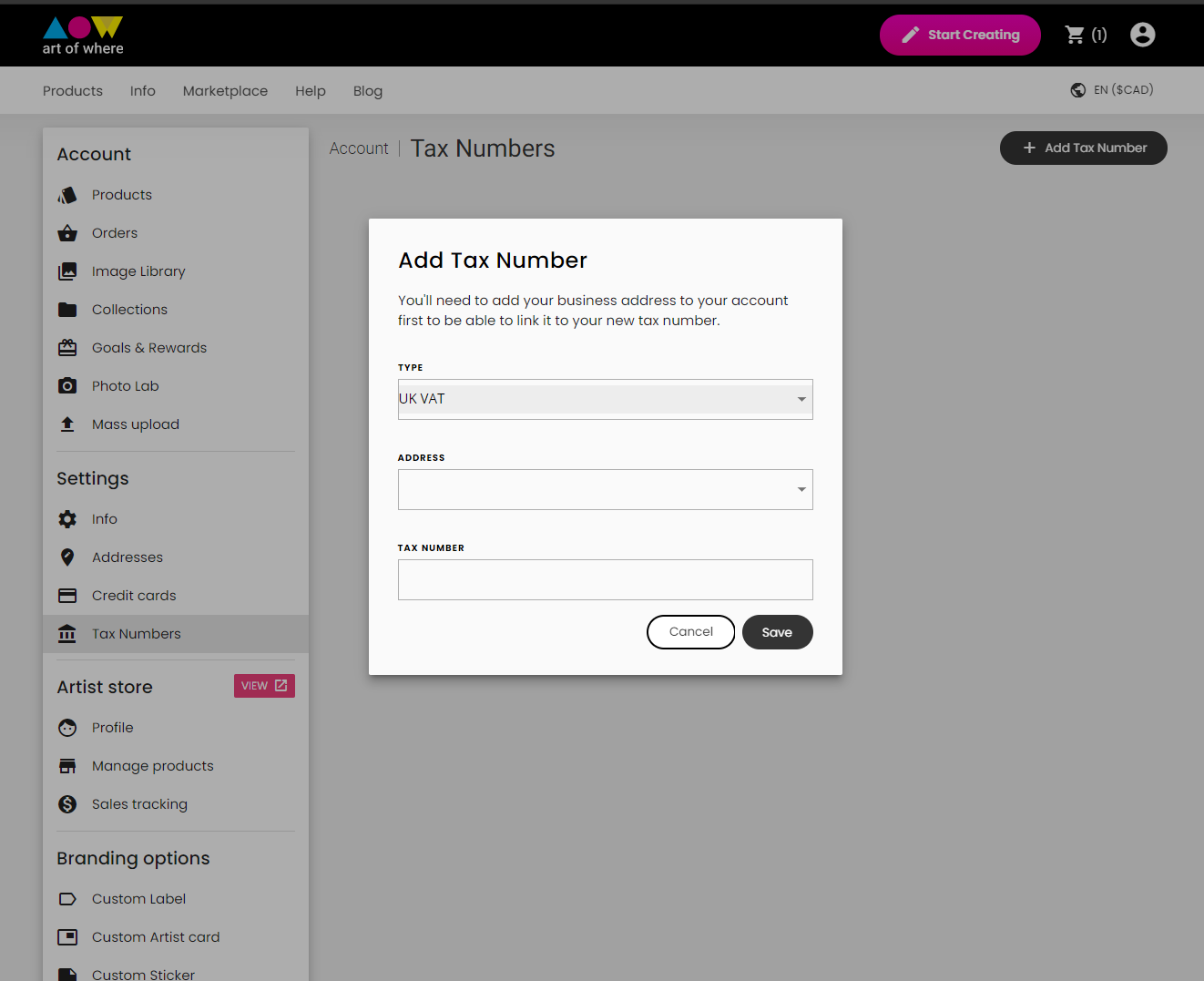

Step 3) Enter your VAT number in your Art of Where account.

We’ve recently launched a new update to your Art of Where account that allows you to easily enter your VAT number. Once you’ve done this, we will know not to charge you the VAT on your orders to the UK. Instead, all orders sent to your customers in the UK will include your VAT number on an invoice. As the VAT number holder, you will be responsible for remitting the VAT to HMRC.

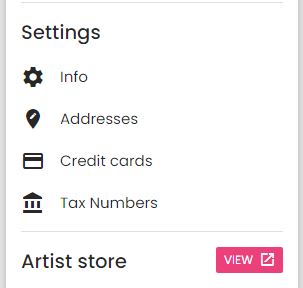

Find the Tax Numbers section in your account screen. You'll be able to put in your VAT number here.

Here it is in the menu:

And this is where you enter the number:

You'll notice that there are 2 other options for tax number including BC and Saskatchewan PST. We'll have a seperate blog about those!

FAQ about VAT and your Drop Ship Business

What amount of sales per year should I be making in the UK per year to qualify for a VAT number? If you plan to even make 1 sale to a customer in the UK, you will qualify for a VAT number.

What costs are associated with a VAT number? Obtaining a VAT number is free. Once you have a VAT number, you need to file VAT returns with the HMRC quarterly. Depending on how you go about this process and if you use a service to help with the return, there may be costs associated with the returns.

Do I need to charge VAT in my store on all my orders that ship to UK customers? If you have a VAT number, you need to charge VAT in your online store and clearly display it on the customers receipt. If you do not have a VAT number, we will charge you the VAT and remit it to the HMRC.

Do I pay VAT on my retail price or on the price of the drop ship product from Art of Where? When you purchase a product from Art of Where, we charge you VAT on the drop ship price.

I have a VAT number. How does it change what I pay for drop shipped products from Art of Where? If you have a VAT number that is entered into you AOW account, we will not charge you VAT on products that ship to the UK.

My orders are typically under $20. Does VAT still affect me? Yes! Previously low-value orders (under approx $20USD) did not qualify for VAT but now they do and need to be charged VAT on your store (if you have a VAT number) or by us when you submit the order to Art of Where.

That's it for this blog! If you have questions, we encourage you to checkout some of these links to learn more about VAT. If you're still not sure about what to do for VAT for your drop ship business, get in touch with us!